As the world continues to open and return to somewhat normalcy, the workplace is also shifting to welcome employees back into the office. Returning to work will not be as simple as announcing a date and carrying on usual business, there are rules and safety measures to take in order to make your employees as comfortable as possible. Every employer is different, but by considering the post COVID workplace protocol, you can prepare and execute your organization’s return to work plan.

Interested in Safety Solutions for Your Organization? Check out our Safety Solutions

New Regulations, Relief, and Credits

From new tax relief credits to new regulations, working in HR means understanding the current happenings in the legislation and how it will affect your organization.

Families First Coronavirus Response Act (FFCRA)

According to the Department of Labor, “The Families First Coronavirus Response Act (FFCRA) requires certain employers to provide employees with paid sick leave or expanded family and medical leave for reasons related to COVID-19″. Small and midsize employers can also receive full reimbursement on their taxes for providing paid sick leave and family wages to their employees for leave related to COVID-19. The tax credits have been extended for employers through September 30, 2021. Eligibility includes employers who voluntarily continued to provide paid leave consistent with FFCRA.

American Rescue Plan Act

The American Rescue Plan Act (ARPA) was signed into law on March 11, 2021, and is an extension of previous COVID relief packages. ARPA extends the Payment Protection Program, payroll tax credits, and paid leave provisions established by FFCRA.

What’s New?

Under the new provisions from the ARPA and FFCRA, Employers and HR should be aware of the following:

Sick Leave and Time off

- The paid sick leave has extended to include paid time off for vaccinations

- The 10-day limit for sick leave has been reset. This means if employees took sick leave previously then the clock has been reset.

- The availability of paid leave cannot discriminate in favor of highly compensated employees, full-time employees or employees on the basis of tenure with the employer.

- Employees now have 14 weeks of paid leave available with both sick and EFMLA leave. This breaks down to 2 weeks of sick leave and 12 weeks of family leave.

Tax Credits

- The previous FFCRA credits expired on March 31, 2021. To qualify for the new tax credit, organizations need to provide a new bank of 80 hours to their employees beginning on April 1, 2021.

- The maximum tax credit for two weeks paid sick leave (80 hours) is $511 per day per employee or $5,110 in aggregate, at 100% of the regular employee wages per day except for caring for others (2/3rds). Tax credits are applied to the employer’s share of the Medicare Tax.

- FFCRA COVID Sick Leave and Emergency Family Leave (EFMLA) tax credits have also expanded.

- Employees can request a leave of absence (LOA) under this provision for any of the reasons listed under FFCRA (including 2 expanded reasons; provided later)

- Removes the 2-week unpaid waiting period and eligible paid LOA increases from 10 weeks to 12 weeks

- The maximum tax credit for EFML is $200 per day per employee or $12,000 per employee in aggregate, at 2/3rds of the employee’s regular rate of pay.

- Tax credits are increased with applicable health insurance premiums paid by the employer and not reimbursed & the employer’s share of FICA taxes paid through payroll or amended 941’s

- Tax credits are applied to the employer’s share of the Medicare Tax. If Medicare Tax isn’t enough to cover the credits, other taxes can be held and not paid to cover these amounts.

COBRA Subsidies

- Under the ARPA, employees who lost group health coverage during COVID-19 due to involuntary termination or reduction of hours can receive fully subsidized COBRA coverage from April 1, 2021 through September 30, 2021. This is mandatory for employers with 20 or more full and part-time employees in the prior year.

- COBRA does not apply to those not eligible for benefits or moving to Medicare or other plans. Terminated employees have to advise the employer when they are eligible for another plan or they will face individual government penalties.

- COBRA does include terminated employees still in their COBRA time period, which is typically 18 months with the same 60 day enrollment period. Employers can also give newly-laid off employees 90 days to elect to enroll in the same or different group plan offered by their employer.

- The government will pay 100% of the COBRA insurance premiums for eligible employees. Subsidies can be obtained through a payroll tax credit for the coverage or amended 941s.

- In order to participate, COBRA notices should be updated before May 30, 2021.

Dependent Day Care

- ARPA increases the income exclusion or employer-provided dependent care assistance programs such as FSAs. The increase is now from $5000 to $10,000 and from $2500 to $5250 for married individuals filing separate returns.

Pandemic Unemployment

- Pandemic unemployment programs have been extended through September 6, 2021. Additional unemployment boosts may range from $100-$300 per week, based on applicable benefits.

Pension Plan Relief

- ARPA now includes other Emergency Pension Plan Relief and funding relief for plans facing hardships. If this applies to your business, please refer to your provider for more information.

What does Post COVID Workplace Protocol Look Like?

While normal is still on hold, many employees’ responsibilities has shifted over the course of the last year. As we begin transitioning back to working at the office, there are some key processes that can be implemented into your post-COVID workplace protocol.

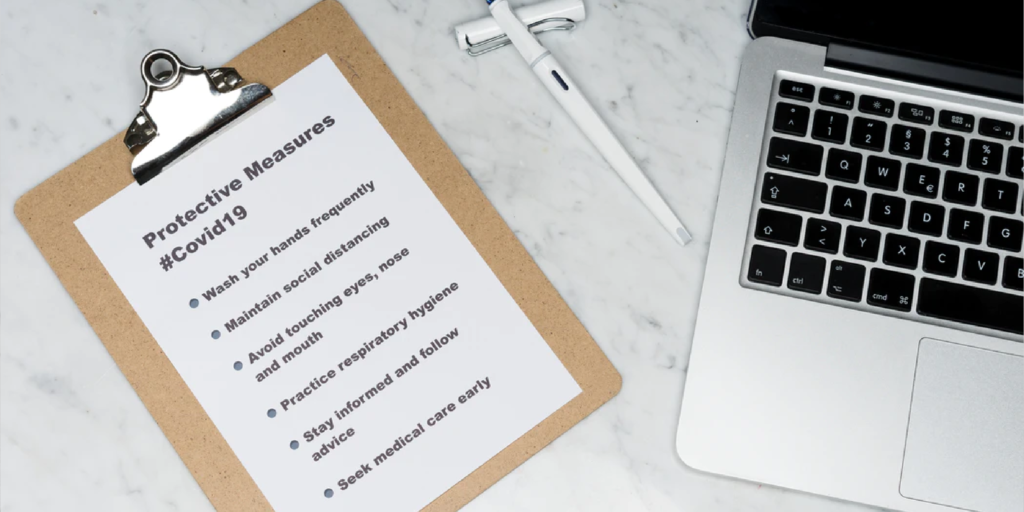

Cleaning and Disinfection is Still Key

- With safety still at center stage, increased health protocols will remain in the workplace. HR leaders should instruct that the surfaces and facility continue to be cleaned and disinfected regularly. You can provide wipes, hand sanitizer, and masks to employees and visitors throughout the office and at main entry points.

Social Distancing and Workplace Layout

- Place desks and work areas 6 feet apart to remain socially distanced. You can also host virtual meetings with employees and clients when possible. If applicable, employers can stagger work schedules to eliminate crowded offices.

Employee Health Screenings

- Employee health remains a top priority in the return to work programs. While some states do require screenings, we recommend checking temperatures, completing confidential screenings as well as wearing masks per CDC, local and state guidelines.

Employee Safety Training

- In addition to screenings, HR should host safety training seminars within the office. This allows you to educate employees on workplace hygiene, safety, and necessary procedures when it comes to COVID-19. Update the staff on sick leave and the need to get tested when presented with symptoms. HR should also be aware of mental health considerations and provide employees with resources and assistance to seek help.

Remote Work

- Employees may prefer to work from home, consider developing a remote work from home policy for your company. This allows you to be more flexible, mitigate risk and lead to retention of employees.

How HRC Can Help You Navigate the Post COVID Workplace

As your helping hand to the world of human resources, HR Collaboration Group is here to assist with navigating the post-COVID workplace. Our team of experienced HR professionals can assist with policy creation and administration, training, screening templates, communication plan, HR consulting, and more! With companies beginning to open their doors once again, we encourage you to stay up to date on regulations and policies. If you need assistance with any of the new protocols, please reach out to a member of the HR Collaboration Group team – we are here to help!